Reviews Write New Review

Location

Booking Fee

Fee: $##,###Get Pricing

Virtual Fee: $##,###Get Pricing

[email protected]

Carmen M. Reinhart

International Finance Professor at Harvard's Kennedy School; Co-author, "This Time Is Different"

Dr. Carmen M. Reinhart is the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School.

Previously she was the Dennis Weatherstone Senior Fellow at the Peterson Institute for International Economics and Director of the Center for International Economics at the University of Maryland.

Prior to her academic appointments, Reinhart was chief economist and vice president at the investment bank Bear Stearns in the 1980s and spent several years at the International Monetary Fund.

She is a research associate at the National Bureau of Economic Research, research fellow at the Centre for Economic Policy Research, and member of the Congressional Budget Office Panel of Economic Advisers and Council on Foreign Relations. Carmen has served on many editorial boards and has frequently testified before Congress.

She has written and published on a variety of topics in macroeconomics and international finance including international capital flows, capital controls, inflation and commodity prices, banking and sovereign debt crises, currency crashes, and contagion.

Her work has been published in scholarly journals such as The American Economic Review, the Journal of Political Economy, the Quarterly Journal of Economics, and the Journal of Economic Perspectives. As well, her work is featured in the financial press, including The Economist, Newsweek, The Washington Post, and The Wall Street Journal.

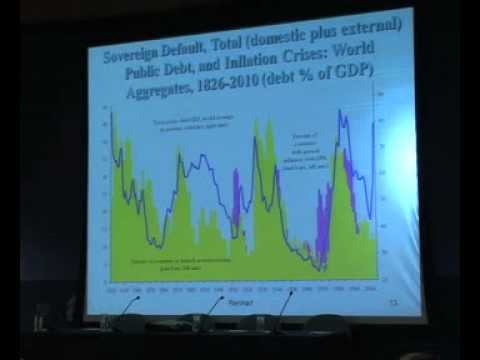

Her book, co-authored by Kenneth Rogoff, This Time is Different: Eight Centuries of Financial Folly studied the striking similarities of the recurring booms and busts that have characterized financial history and won the 2010 Paul A. Samuelson TIAA-CREF Institute Award.

Speech Topics

A Decade of Debt

The global outlook focuses first on the risks in advanced economies stemming from a record public and private debt overhang, stubbornly high unemployment, and subpar growth. Debt restructurings and other forms of haircuts and financial repression are not likely to be limited to Greece and Cyprus. The vulnerabilities in emerging markets associated with large capital inflows: credit booms, currency overvaluation, booming asset prices and rising credit are also discussed.

Financial Crises

This Time is Different

Books

Related Speakers View all

|

Joseph Stiglitz

American Economist, Professor at Columbia Universit...

|

|

Sallie Krawcheck

Founder & CEO of Ellevest; Author of "Own It: The Po...

|

|

Dambisa Moyo

Global Economist, Author & Investor in the Future

|

|

Alan Blinder

Economic Commentator at CNBC, Former Vice Chairman a...

|

|

Stacey Cunningham

Former President of the New York Stock Exchange; Exp...

|

|

Alberto Alesina

Professor of Political Economy at Harvard University...

|

|

Rupal J. Bhansali

SVP & Chief Investment Officer at International Equi...

|

|

Carly Fiorina

Businesswoman, First Woman to Lead a Fortune Top 20 ...

|

|

Xavier Sala-i-Martin

Chief Economic Advisor to the World Economic Forum

|

|

Carla Harris

Managing Director & Senior Client Advisor at Morgan ...

|

|

Anil Gupta

Leading Expert on Strategy, Globalization & Emerging...

|

|

Jason Schenker

Top-Ranked Economist, Best-Selling Author, President...

|

|

Ray Dalio

Founder & Chief Investment Officer at Bridgewater As...

|

|

Stephen Schwarzman

Chairman & CEO of The Blackstone Group

|

|

Mary Callahan Erdoes

CEO of J.P. Morgan Asset & Wealth Management

|

|

Jeremy Siegel

Finance Professor & Author

|

|

Parag Khanna

Managing Partner at FutureMap; Strategic Advisor to ...

|

|

Katty Kay

Award-Winning Journalist & Anchor; Best-Selling Author

|

|

Bill George

Senior Fellow at Harvard Business School, Best-Selli...

|

|

Esther Dyson

Executive Founder of Way to Wellville

|