Reviews Write New Review

Location

Booking Fee

Fee: $##,###Get Pricing

Virtual Fee: $##,###Get Pricing

[email protected]

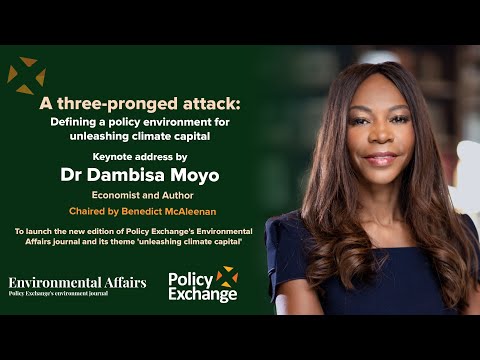

Dr. Dambisa Moyo is an international economist who analyzes the macroeconomy and global affairs. She has traveled to more than 50 countries over the last decade, during which time she has developed a unique expertise on the political, economic, and financial workings of emerging economies, in particular the BRICs and the frontier economies in Asia, South America, Africa and the Middle East. Her work examines the interplay between rapidly developing countries, international business, and the global economy, while highlighting key opportunities for investment.

At the podium Dr. Moyo engages audiences with her unmatched expertise in finance and emerging markets. She discusses everything from where to invest, why to invest, risk vs. uncertainty and where macro-economic policy is headed. With her impressive background and gift for examining issues in a new light, Dr. Moyo keeps audiences hanging on her every word.

Dr. Moyo serves on the boards of Barclays Bank (the financial services group) SABMiller (the global brewer) and Barrick Gold (the global miner). She worked as an economist at Goldman Sachs for nearly a decade and was a consultant to the World Bank in Washington, D.C. She is the author of the New York Times best-sellers "Dead Aid: Why Aid is Not Working and How There is a Better Way for Africa" and "How the West Was Lost: Fifty Years of Economic Folly and the Stark Choices Ahead." Her third book, "Winner Take All: China’s Race for Resources and What it Means for the World," was published in June 2012 and premiered at #13 on the New York Times best-seller list.

Dr. Moyo was named as one of the “100 Most Influential People in the World” by TIME Magazine and to the World Economic Forum’s Young Global Leaders Forum. She was awarded the 2013 Hayek Lifetime Achievement Award named for the economist, Nobel Prize winner and recipient of the Presidential Medal of Freedom, Friedrich von Hayek.

Dr. Moyo is a contributing editor to CNBC. Her writing regularly appears in economic and finance-related publications such as the Financial Times and the Wall Street Journal.

She has a PhD in economics at Oxford University and holds a Masters degree from Harvard University. Dr. Moyo completed her undergraduate degree in chemistry and an MBA in finance at American University in Washington, D.C.

Speech Topics

Global Growth Outlook

Unpacking Technology

Investment Themes in a De-globalizing World

Democracy Under Siege: Timelines and Policy Trajectory after Trump and BREXIT

The Coming Global Commodity Crisis

Since 2009, commodity prices have increased over 150%. Dambisa Moyo reveals how commodity scarcity is one of the biggest challenges the world will face over the next decade, leading to higher commodity prices, increased risk of commodity-related conflicts (already there are 25 on-going conflicts around the world with their origins in commodities), and a notable decline in living standards. She details how insatiable commodity demand emanating from a rising global population, increasing wealth, particularly in the emerging world, and rapid urbanization, will outstrip the worlds resource supply of arable land, water, energy and minerals. She explains how forecasts for technology innovations, substitutes (such as shale and non-fossil fuels – solar, wind, nuclear) are overestimated and overly optimistic, and how their risks are not adequately understood. In this context she will discuss how and which specific commodities investors ought to buy versus sell across tradable (energy, minerals) and non-tradable (land, water) commodities, which are all scarce, finite and depleting.

Schism: The Coming Economic & Political Paradigm

Developing countries – where 90 percent of the world lives – are at a crossroads. They are facing a choice between the US model of democracy and private capitalism or the Chinese model of state capitalism and no democracy. Dr. Moyo explains why, in the eyes of many people and policymakers who live across the emerging world, the Western model is under threat, and why the model adopted by China offers a compelling option. With over 70 percent of the population under the age of 25 years across developing countries, there is a growing momentum to focus on delivering economic outcomes and improvements in living standards and de- prioritizing efforts in support of democracy. Dambisa Moyo explains why this pivot is under way, the consequences for geo-politics and global economics, and what the US and the West must do in the face of the choice to compete or cooperate with these emerging economic and political trends.

The Markets and Macro Outlook for the US

Where should investors look to invest in the US economy? Global economic challenges in the aftermath of the financial crisis are well known: unsustainable debts and deficits, ageing workforces, declining productivity and ballooning entitlements, such as pension liabilities and healthcare, that governments and societies will struggle to pay for. Dambisa Moyo explains the range of options and monetary and fiscal policies tools needed to address these challenges. Dr. Moyo draws on her nearly 10 years at Goldman Sachs to outline the most compelling US investment opportunities in stocks, bonds, real estate, commodities, FX and cash.

Africa’s Time is Now

Based on IMF forecasts, sub-Saharan Africa is poised to be the world’s third fastest growing region in 2013 and 2014. This is due to solid debt and deficit dynamics, attractive labor trends and upward mobility and numbers of young workers, and important productivity gains. Dambisa Moyo provides a snapshot of the macroeconomy and markets to illustrate the investment opportunities for corporations and financial investors. She explains how the African investment landscape is more than just a commodity story – as over 85% of the roughly 1,000 stocks that trade on Africa’s 19 stock exchanges are non–commodities, indicating significant investment opportunities in the banking and insurance, logistics, telecommunications and retail sectors. Dambisa Moyo will detail how capital markets development in stocks and bond markets (20 African countries have credit ratings from leading international ratings agencies) offer investors an opportunity to invest in Africa’s consumer and economic themes. Companies ignore Africa’s investment trend and opportunities at their own peril.

The Hunt for Alpha Leads to the Frontier

Dambisa Moyo applies her extensive knowledge and experience to detail the superior, uncorrelated risk- adjusted investment returns of Frontier Economies – the emerging economies excluding the BRICs. She contrasts the investment opportunity of developed and emerging economies, in order to highlight the significant returns available in both the public markets (for example, stocks bonds, FX and credit) and private equity across frontier economies such as Vietnam, Turkey, Nigeria, Columbia, and Estonia. She will also advance how the macroeconomic outlook of these economies are both compelling and buttressed by solid economic fundamentals. Moreover, she will provide insight around risk and liquidity in the frontier economies, explain rapidly changing perceptions, and reveal significant investment opportunities for savvy investors.

Dead Aid: Why Aid Is Not Working and How there is a Better Way for Africa

Dambisa Moyo explains why US$1 trillion of aid sent from rich West countries to Africa has been an economic and political disaster. Despite good intentions, aid led to slower economic growth, higher poverty levels and incompetent government in recipient countries. Dr. Moyo explains exactly what policies the international community should adopt to support African countries in their efforts to create sustainable economic growth and put a significant dent in poverty. Dambisa Moyo provides a historical context for how the aid model has evolved over the past 5 decades and the range of economic and political problems aid introduces to poor countries, trapping them in a vicious circle of aid dependency, corruption, market distortion, and further poverty.

Inside China: China’s Economic Risks and Opportunities

By 2020 China is forecasted to become the largest economy in terms of GDP. Dr. Moyo details the implications of China, the worlds most populist nation, taking the helm for global trade, geo-politics, and the worlds financial infrastructure (equities, FX, bonds). Domestic policies will transform China from an investment based economy to consumption driven, this will affect China’s linkages and reach across the emerging world – where 90 percent of the worlds population lives. Dambisa Moyo will present the challenges that China faces and the risk to her ascendancy including: demographic shifts, commodity scarcity, shadow financing, and a non- democratic political infrastructure. Whether its businesses, politicians or individuals, we can’t afford to not understand what we are up against. China’s Race for Commodities and What it Means for the World Dambisa Moyo explains the three-pronged strategy that forms China’s systematic and deliberate global campaign for global resources. The scale of China’s race for resources is astounding – current spending is approximately US$1 billion a week to secure commodity assets worldwide. China is set apart from other countries and her strategy directly affects commodity prices and geo-politics. Dr. Moyo will outline how China’s aggressive approach – buying mines and agricultural land, re-routing rivers, and lending billions of dollars in cash in return for access to oil fields – places her in a unique position, particularly across the worlds emerging economies. Dambisa Moyo explains why China’s resource campaign has far-reaching implications for the price of resources and the manner in which commodity prices trade on and off global market exchanges.

The American Dream versus the Chinese Vision

Dambisa Moyo contrasts the on-going economic challenges of the West and the Rise of the Rest – countries like Brazil, Russia, India and China. She explores how deliberate policies in the US led to the erosion of capital, labor and productivity – the three key ingredients that drive economic growth. Dr. Moyo outlines how, against the recent prosperity of the BRICs, the US economic difficulties and Europe’s debt crisis tip the global balance and impact living standards of the average American. She details the interlinkages of debt, trade and geo- politics between the two major world economies and scenarios of how their interdependency can be triggered to survive or disintegrate.

A Call Against Complacency

For over 300 years, the market based capitalist model, built on a culture of incentives, has been successful in creating economic growth, powering industrialization, driving western competitiveness, and meaningfully reducing poverty around the world. Over the last 50 years deliberate government policies in the US have incentivised bad behavior and caused widespread negative unintended consequences and eroded the three key drivers of economic growth; capital, labor and productivity. Dambisa Moyo details the policies that will induce individuals to make the right choices that will lead to America’s long-term economic success. She will explain what policies America needs to engineer a turnaround and set the US and Western economies back on track.

Meeting the challenges of the evolving global economy

Dambisa Moyo offers recommendations for how global businesses will make investment decisions, manage their people, finance expansion across products and geographies, mitigate risk how to remain profitable, be competitive and expand their businesses in an economically challenging global economy. Having visited over 50 countries, she leverages her experiences, on-the-ground network and relationships with politicians, policymakers, business persons and opinion leaders to inform a practical strategy for businesses investing across the developed and developing world. She explains what businesses and households have to do to strengthen their balance sheets, and details the policy actions that governments must take to ensure the West is on a constructive long-term economic path.

Snapshot of the Global Macroeconomy

International economist Dambisa Moyo identifies and contrasts the tactical, short-term challenges (debt and deficit management) versus structural problems (unemployment, depleted infrastructure etc) affecting the global economy. Dr. Moyo will explain the four directions that the global economy could take over the coming years in the aftermath of the financial crisis. She highlights the risks in the global macroeconomy and geo-political order with weaker global growth and the possibilities of the disintegration of the G-20, disagreements on the path of banking regulation, increased protectionism via outright trade policies and FX interventions (such as beggar-thy- neighbour policies). Against this backdrop Dr. Moyo considers the convergence economically and politically and advises on the best strategic plans for global businesses.

Books

News

Related Speakers View all

|

Joseph Stiglitz

American Economist, Professor at Columbia Universit...

|

|

Sallie Krawcheck

Founder & CEO of Ellevest; Author of "Own It: The Po...

|

|

Ian Bremmer

President of Eurasia Group and GZERO Media; Politica...

|

|

Carla Harris

Managing Director & Senior Client Advisor at Morgan ...

|

|

Jason Schenker

Top-Ranked Economist, Best-Selling Author, President...

|

|

Peter Zeihan

Energy & Geopolitical Strategist, Author of "The Abs...

|

|

Richard Florida

Leading Urbanist, Economist & Author of "The Rise of...

|

|

Peter Diamandis

Founder & Executive Chairman of the XPRIZE Foundatio...

|

|

Mike Walsh

CEO of Tomorrow, Futurist & Best-Selling Author of "...

|

|

Ben Stein

Political Economist, Commentator, Author & Actor

|

|

Andrew Busch

Artificial Intelligence & Technology Futurist; Econo...

|

|

Amin Toufani

CEO of T Labs, Creator of Adaptability.org, Chair fo...

|

|

Jalak Jobanputra

Founder & Managing Partner of FuturePerfect Ventures...

|

|

Daymond John

"Shark Tank" Investor; Founder & CEO of FUBU; Presid...

|

|

Amy Myers Jaffe

Leading Expert on Global Energy Policy & Sustainability

|

|

Todd Buchholz

Former White House Director of Economic Policy & Man...

|

|

Arlan Hamilton

Founder of Backstage Capital, Venture Capitalist, Te...

|

|

Andrew McAfee

Co-Founder & Co-Director of Initiative on the Digita...

|

|

Anil Gupta

Leading Expert on Strategy, Globalization & Emerging...

|

|

Bill Browder

Founder & CEO of Hermitage Capital Management; Human...

|